Desk rates across the U.S. in 2024 largely remain below 2023 levels, driven by cost-conscious clients. While cities like Los Angeles and D.C. saw rates drop, other markets like Miami and NYC report growth.

In many markets, desk rates in 2024 remain below their 2023 levels, signalling that cost-conscious decision-making continues to influence pricing strategies. Cost reduction remains a top priority for companies, pushing operators to lower desk rates as they aim to attract and retain clients in a competitive landscape.

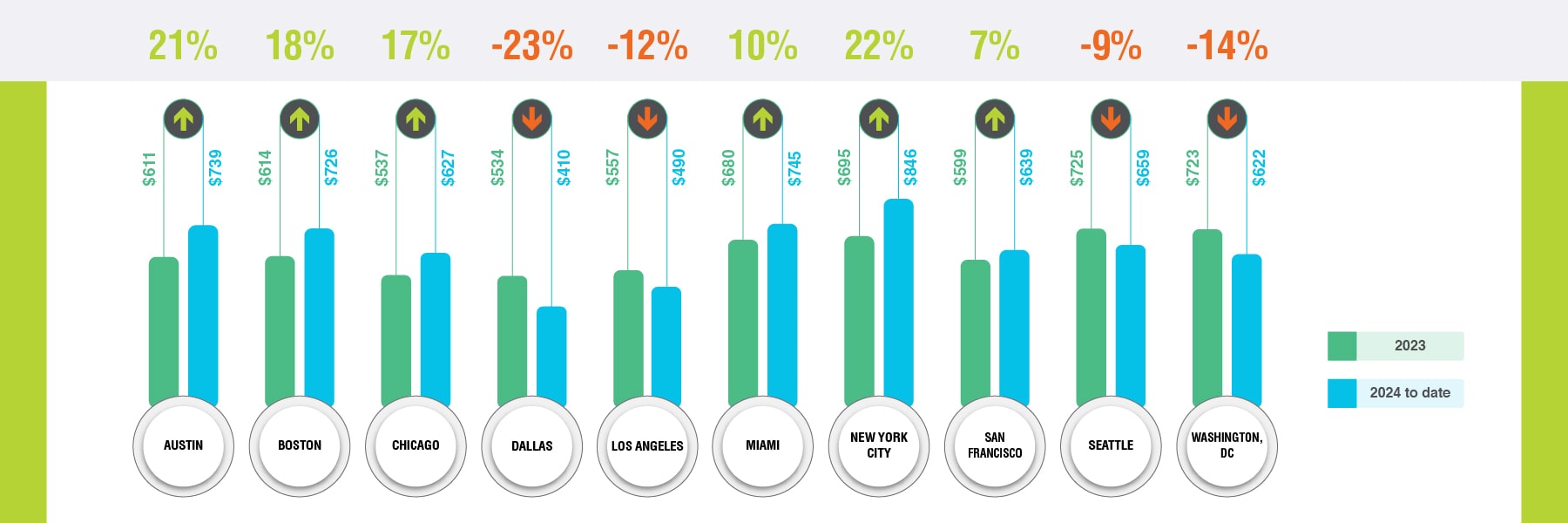

For instance, cities like Los Angeles and Washington D.C. have seen desk rates drop by -12% and -14% year-over-year respectively, with Dallas’ average rate falling most significantly from $534 in 2023 to $410 in 2024. These reductions may reflect operators' strategic response to the demand for cost savings from companies grappling with inflationary pressures and economic uncertainty.

However, other markets have seen moderate growth. Miami, for example, experienced an 10% increase in average desk rates, rising from $680 in 2023 to $745 in 2024. New York City stands out with a significant 22% growth in desk rates, reaching $846 in 2024 compared to $695 in 2023. This demonstrates the diversity of market dynamics in different regions.

The U.S national average for desk rates stands at $459/month in 2024, a slight increase from 2023’s average of $455/month, indicating that overall market growth is steady but nuanced across regions.

THE DRIVE BEHIND PRICE INCREASES

Despite many markets seeing a dip in rates, strong demand growth and positive market conditions provide operators with the opportunity to increase desk rates. According to our 2024 Global Partner Survey Report, an overwhelming 78% of flexible office operators plan to increase their rates over the next year. These planned hikes are largely a response to rising operational costs, such as inflation, maintenance, and staffing, which continue to pressure business margins.

However, increasing prices is not without challenges. The delicate balancing act for operators lies in boosting revenue without alienating cost-conscious clients. As businesses increasingly focus on cutting overheads, operators must navigate the fine line between staying competitive and meeting their financial targets.

STRATEGIES FOR STAYING COMPETITIVE

In an industry driven by flexibility, operators can navigate this pricing conundrum by offering creative solutions. While increasing desk rates might be necessary to cover rising operational expenses, operators can differentiate themselves through adaptable offerings that appeal to a range of clients.

Introducing book-and-pay options for smaller, short-term needs allows operators to capture a larger market share while providing flexibility for businesses needing temporary or fluctuating space.

By offering diverse options like virtual offices, meeting rooms, event spaces, and private offices, operators can boost their revenue streams without relying solely on desk rentals. This approach not only caters to clients looking for cost-effective solutions but also maximizes the operator’s profitability.

THE ROLE OF DATA IN OPTIMISING PRICING

Detailed data on pricing and demand also plays a crucial role in helping operators adjust their strategies to remain competitive. By analysing market trends and understanding the specific needs of their target audience, operators can make informed decisions about when and how much to raise rates.

Using data to forecast demand and anticipate market fluctuations allows operators to stay ahead of the curve, ensuring they can offer competitive pricing while protecting their margins. As demand continues to grow and more businesses seek flexible workspace solutions, those operators who can strike the right balance between competitive pricing and strategic growth will be well-positioned for success in 2024 and beyond.

CONCLUSION

The flexible office industry is entering a new phase of growth and opportunity, but it also faces unique challenges in balancing pricing strategies with client expectations. With many operators planning to increase desk rates, the key to success lies in offering diverse and flexible solutions that appeal to both cost-conscious and growth-driven clients.

By leveraging data-driven insights and creative pricing models, operators can thrive in this evolving market while continuing to deliver value to their clients.

Want more insights into the current U.S. office market, such as demand and desk inquiry trends? Check out our 2024 State of the U.S. Flexible Workspace Market report.