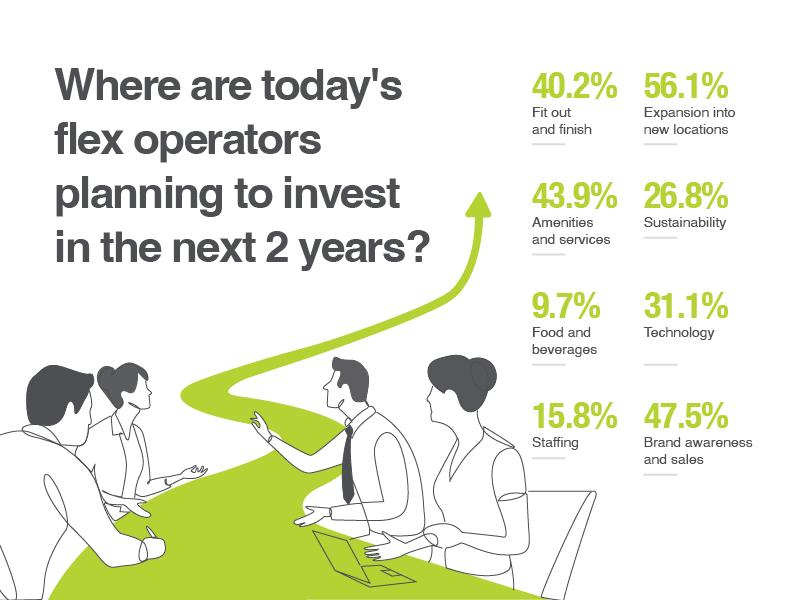

From expansion to sustainability, our 2024 Fixed to Flex Partner Survey points to where operators are focusing their investment over the next two years.

As the flexible office space sector continues to evolve, operators are focusing on key areas to enhance their offerings and meet the changing needs of businesses.

Our 2024 Fixed to Flex Partner Survey revealed the top investment priorities for global flex industry leaders over the next two years, including responses from coworking operators, flexible office providers, and landlords. Let’s delve into the findings and explore what they say about the future of operator investment across the industry.

Expansion to New Locations (56.1%)

Leading the pack is the expansion to new locations. With over half of operators planning to invest in expansion, it's clear that the demand for flexible workspaces is rising. Businesses are looking for more options and greater accessibility, driving operators to open new locations in existing or new markets. Both in the US and the UK, 100% of survey respondents said they will look to invest in expansion over the next two years. This trend underscores the growing acceptance of flexible work models and the need for diverse, convenient workspace solutions.

In recent experience, more and more operators (and landlords) are relying on our flex market data and insights to make informed investment decisions when evaluating new locations.

Brand Awareness and Sales (47.5%)

Nearly half of the survey respondents highlighted brand awareness and sales as a significant investment area. In a competitive market, building a strong brand identity and effectively reaching potential clients is crucial. Operators are focusing on marketing strategies and sales initiatives to differentiate themselves and attract a broader client base. This emphasis on branding indicates a maturing market where operators recognize the importance of standing out and delivering value.

Amenities and Services (43.9%)

Amenities and services are also high on the priority list, with over 43.9% of operators planning to enhance their offerings in this area. Modern businesses and their employees expect more than just a desk and Wi-Fi. They seek a holistic experience that includes wellness facilities, collaborative spaces, and personalized services. Investing in amenities and services helps operators create a vibrant and appealing environment that caters to diverse needs.

Fit Out and Finish (40.2%)

The physical appearance and functionality of workspaces remain a critical focus, with 40.2% of operators planning investments in fit out and finish. A well-designed, aesthetically pleasing environment can significantly impact productivity and employee satisfaction. Operators are looking to create spaces that are not only functional but also inspiring and comfortable, reflecting the shift towards more employee-centric workplace design that benefits productivity.

Technology (31.1%)

Technology continues to be a driving force in the flexible office sector, with 31.1% of operators planning tech upgrades. From high-speed internet and smart office solutions to advanced security systems, technology enhances the efficiency and attractiveness of workspaces. As remote work and hybrid models become more prevalent, reliable and innovative tech solutions are essential to meet the evolving demands of modern businesses.

Sustainability (26.8%)

Sustainability is gaining traction, with 26.8% of operators planning investments in this area. As businesses increasingly prioritize environmental responsibility, operators are focusing on sustainable practices and green building certifications. In both the US and the UK, 100% of survey respondents claimed they will invest in sustainability over the next two years. This shift towards sustainability not only helps attract eco-conscious clients but also contributes to long-term cost savings and improved operational efficiency.

Staffing (15.8%)

Investments in staffing, highlighted by 15.8% of respondents, indicate a recognition of the importance of human resources in delivering exceptional service. Skilled staff members are crucial for managing daily operations, fostering community, and providing personalized support to clients. Enhancing staffing levels and training programs ensures that operators can maintain high standards of service and client satisfaction.

Food and Beverage (9.7%)

While food and beverages are a lower priority compared to other areas, 9.7% of operators still see value in enhancing their offerings. Providing quality food and drink options can significantly enhance the workplace experience, encouraging employees to spend more time in the office and fostering a sense of community.

Conclusion

The findings from the 2024 Fixed to Flex Partner Survey paint a clear picture of a dynamic and evolving flex space sector. Operators are planning to strategically invest in expansion, brand building, amenities, design, technology, sustainability, staffing, and even food and beverages to meet the growing and diverse needs of businesses.

These investments highlight the industry's commitment to creating adaptable, appealing, and sustainable work environments that cater to the modern workforce. As the sector continues to grow, these focus areas will undoubtedly shape the future of flexible workspaces, ensuring they remain a vital part of the business landscape.

If you're considering expansion opportunities, we have you covered with the most comprehensive data and insights offering on the flex market. Plus, a team of experts who can help you make smart investment decisions. Explore our capabilities and contact the team here.

*Note: Statistical percentages do not add up to 100%, because respondents in the 2024 Fixed to Flex Partner Survey were asked to select the three main areas where they were planning to invest in the next two years.