As geographic boundaries of work have eroded and work has evolved from a noun to a verb, new migration patterns are emerging across the U.S. shaping the flexible office landscape.

The pandemic has eroded the geographical boundaries of work, freeing businesses to relocate their or disperse their workforce across hub locations. Due to the shifting economy, rise in hybrid work opportunities and a growing desire to improve work-life balance, new migration patterns are emerging across the U.S. Work has evolved from a noun to a verb, from a place we went, to a thing we do, irrespective of place. Flexible workspaces provide the tools to enable companies to quickly enter new markets and test the feasibility of relocating or dispersing their workforce, without the need for any significant capital outlay.

FROM THE SUBURBS TO INTER-STATE, THE MIGRATION IS GAINING PACE

The rise of remote working has accelerated the move to suburbia over the past two years, with many employees relocating out of urban areas to peripheral cities which offer more cost-effective real-estate and improved lifestyles, while still being within a commutable distance of the city center. This trend is playing out across San Francisco, where the exodus of employees to the growing East Bay cities has reversed flexible workspace trends and is driving up demand in Oakland (+127%), Alameda (+500%) and Berkeley (+100%) whereas it has dropped -24% in San Francisco since pre-pandemic.

The realization that hybrid work is no longer a short-term reaction but rather a long-term strategy, is leading companies to look beyond the suburbs to new emerging business hubs in other states, giving rise to the migration of companies across the U.S.

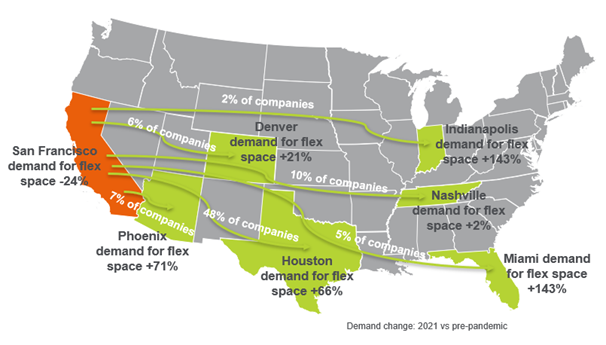

Business migration is happening on a large scale across the U.S., but California in particular has seen a significant number of companies relocate their headquarters away from the state in recent years, including Oracle and Tesla. Texas is absorbing almost half of all companies leaving California2, driving up demand for flex space across the state - Austin +26%, Dallas +32% and Houston +66% when compared to pre-pandemic levels.

Tech companies are flocking to Houston, which is establishing itself as the next Silicon Valley thanks to its easy access to talent, lower taxes, and favorable employee laws. The relocation of tech giants to the city, is attracting similar companies who want to establish offices close to the leaders in their industry. As a result, demand for flex space from the tech sector soared 167% in Houston since pre-pandemic, compared to a 33% drop in San Francisco.

THE PULL OF LIFESTYLE CITIES

Lifestyle cities are also experiencing an influx of demand for agile workspaces, with Florida leading the race to flexibility. Orlando (+84%) and Tampa (+50%) have seen demand rebound at phenomenal rates, but Miami has experienced the highest growth in demand of any city nationally since pre-pandemic (+143%). Its warm climate and lower taxes make it a haven for freelancers. However, with Amazon now joining a long line of corporate companies establishing a foothold in Miami, it is no longer just start-ups who are attracted to the Sunshine State. Demand for larger spaces of 10-25 desks increased 31% over the past year, and this trend is continuing on an upward trajectory. Miami has some of the highest desk rates outside of NYC, as competition is steep, and some companies may find themselves priced out of the city.

This shift is fuelling the migration of businesses across the U.S. as it enables them to provide an improved lifestyle for employees as well as access a wider and more diverse talent pool. New business migration patterns are shaking up the flexible workspace landscape, turning lifestyle cities into new business hotspots and generating new industry-specific hubs.

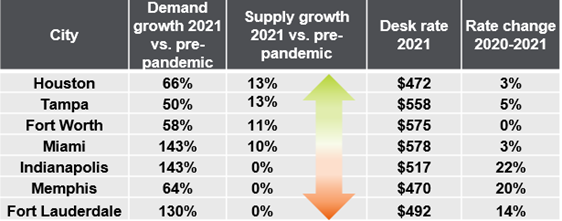

DEMAND-SUPPLY DYNAMICS ARE IMPACTING PRICING

The changing dynamics of demand and supply is resulting in both buyers and sellers’ markets. As demand continues to accelerate, markets where supply growth is lagging are seeing prices jump significantly. In contrast, where supply growth is keeping pace with burgeoning demand, rates are remaining relatively stable in these markets.

The flex market is evolving rapidly, reacting to changes in business habits, meaning the demand-supply balance can tip at any time. Strong demand growth will inevitably result in significant supply expansion and diversification. The question is not if, but when. Now is a unique window of opportunity to acquire flex space at competitive rates in markets where supply and demand remain balanced.

THE FUTURE OF WORK IS QUANTUM, CHOICE IS THE KEY

A culmination of factors is driving changing migration patterns across the US. With 25% of all professional jobs in North America expected to be remote by the end of 20223, many companies will opt to relocate in search of the best talent and places to conduct business. An agile hybrid working model is not binary working, going from home to office but allows employees to work in multiple places in any given day. This will drive significant demand to new and emerging markets and will propel the flex workspace market into the next dimension, forcing it to evolve and grow to meet the ever-changing demands of businesses and their workforce. No one knows what the next normal will bring, but agility will be the key driver for workspace strategy, ensuring that workplaces can run at the speed of business and allow for employee choice.

Sources

- https://fortune.com/2022/01/04/great-resignation-record-quit-rate-4-5-million/Hoover: 2018-2021

- Hoover: 2018-2021

- Forbes - https://www.forbes.com/sites/bryanrobinson/2022/02/01/remote-work-is-here-to-stay-and-will-increase-into-2023-experts-say/?sh=26a0cba320a6