A lack of available supply of flexible workspace will hamper the ability of companies to offer the opportunity to work from anywhere in the coming years.

If just 10% of corporate office portfolios moved to flexible workspace, then there would be a shortfall of nearly 40m sq ft, according to research from The Instant Group and EG.

Corporate occupiers such as Uber, WPP and Currys have all cited their future use of flex space with many predicting that it will make up more than 30% of future portfolios.

KEY FINDINGS

- The Flex market in England and Wales would need to grow by 40% to deliver the needed supply if just 10% of leased office tenants moved to flex

- Major cities would need to grow by less than 20% on average whereas secondary markets would be significantly under-supplied

- London’s flex market is more mature, making it better positioned to absorb additional demand from traditional office occupiers, but this situation is not expected to last

- If a higher percentage of leased office tenants move to flex as is predicted, the growth of flex supply needed to meet demand significantly ramps up. A 20% swing would see the sector needing to double in size from its current position

- The vast amount of vacant traditional office space currently in the market could provide the solution to flex supply growth and would transform the flexible workspace landscape across the UK

CHANGING PERCEPTIONS OF OFFICE SPACE

With expectations of the office shifting as a result of the pandemic, flexibility and a higher level of amenities and services have become key requirements for businesses of all sizes.

An increasing number of leased office tenants are choosing flexible workspaces not only because they offer a lower-risk commitment, but also due to the wider range of products on offer, complete with hospitality-style services and a whole host of amenities.

What does the market need?

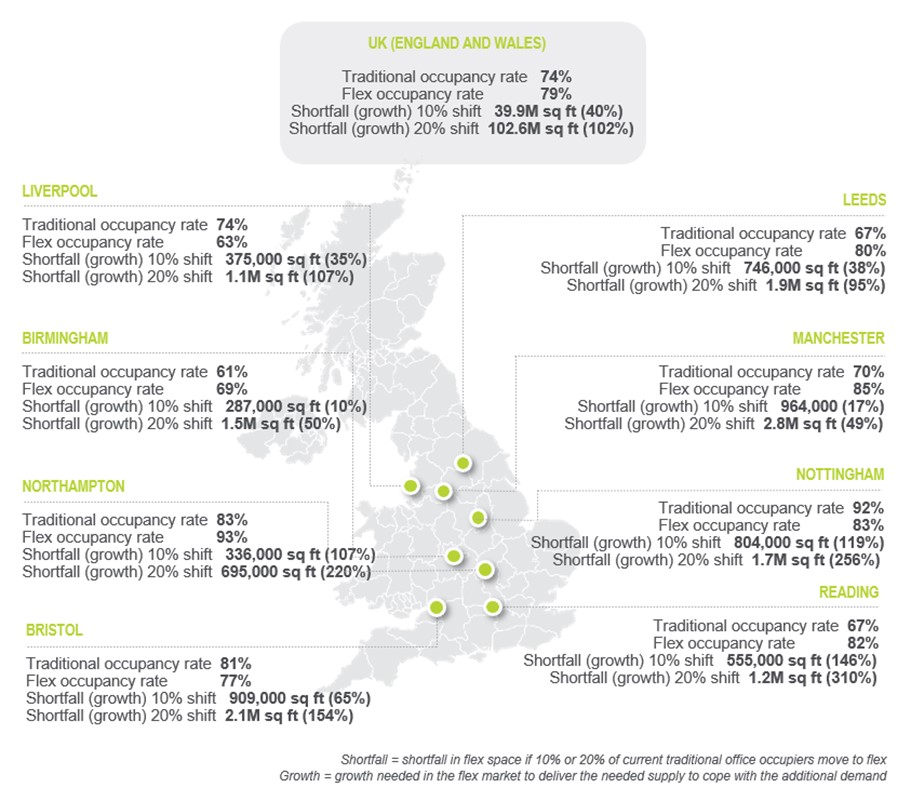

Across England and Wales, around 626 million square foot of traditional office space is currently leased, and if we saw just a 10% shift of occupiers towards flex space, this would create a shortfall in flex supply of around 39.9m square feet.

With contractual occupancy rates within flexible workspaces continuing to rise, this shortfall will only grow, creating a huge growth opportunity for the workspace industry — but can it keep up?

SECONDARY MARKETS ARE AT A DISADVANTAGE

If this scenario plays out across the UK, the effect on flexible workspace supply would ultimately be uneven.

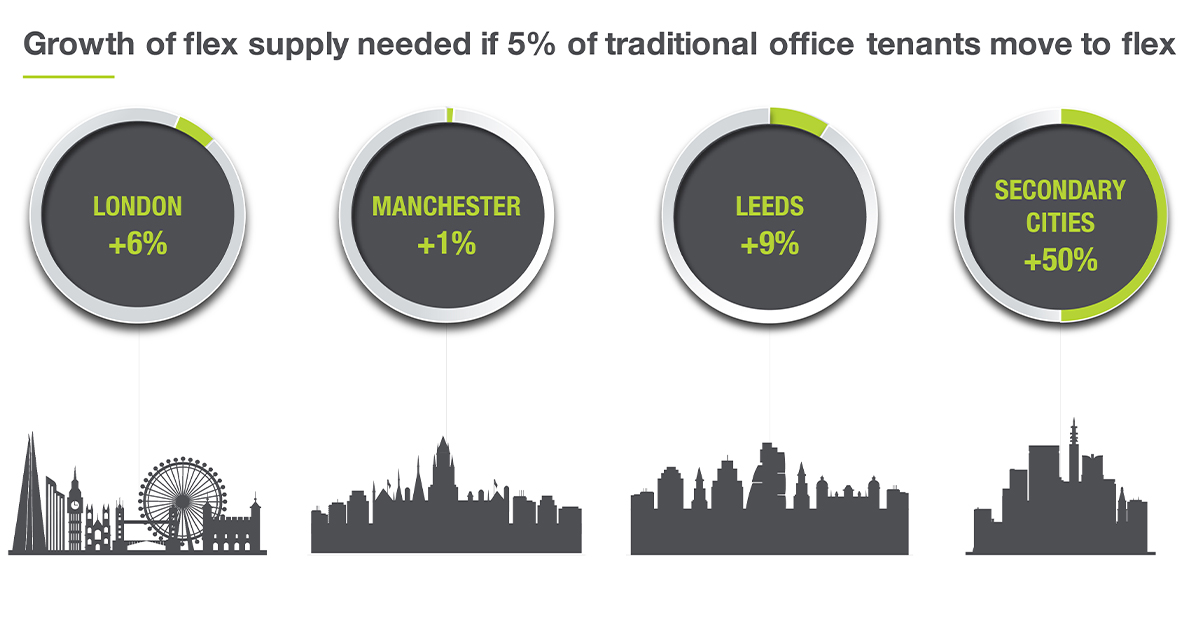

Flex markets in major cities such as Birmingham, Manchester, and Leeds are already mature, with the market share increasing significantly over the past few years. If just 5% of traditional office occupiers in these markets moved to flex, supply would need to grow by less than 10% — an achievable goal given that supply in these markets has already increased by 5%, 4% and 6% respectively over the past 12 months alone.

Secondary Market Shortfall

Secondary markets, on the other hand, would be woefully under-supplied, with markets such as Northampton, Nottingham, and Reading needing to increase their supply of flex workspaces by a minimum of 50%. These markets have experienced little to no supply growth in the past 12 months and so significant investment would be needed for supply to keep pace with demand.

If we saw a shift to flex of closer to 10%, the growth of flex supply needed to meet demand significantly ramps up. Overall, the flex market in England and Wales would need to grow by 40%, and only the more mature markets of Birmingham and Manchester would need to deliver growth of under 20%, with all other UK towns and cities requiring supply growth of 35% and above. Any movement of traditional occupiers above 10% would result in a severe shortfall of flex supply, with demand outpacing available flexible space.

A move away from the Capital?

We are also seeing a shift in demand from London to regional cities, which will further compound the lack of supply in these markets. Just 25% of users on the instantoffices.com digital platform looking for offices in Manchester are based in the city, as many businesses – on the hunt for cost reduction and access to a wider talent pool – are incorporating regional hubs into their office portfolios or relocating their head offices away from London.

Regional markets are key targets for operators in 2022 - for example, Cubo and Wizu are opening in Leeds, and Serendipity Labs and X+Why are entering the Manchester market. But these expansion plans will need to reach beyond major cities if the flex sector is to absorb office occupiers moving away from traditional leases.

LONDON’S MATURE MARKET IS WELL POSITIONED

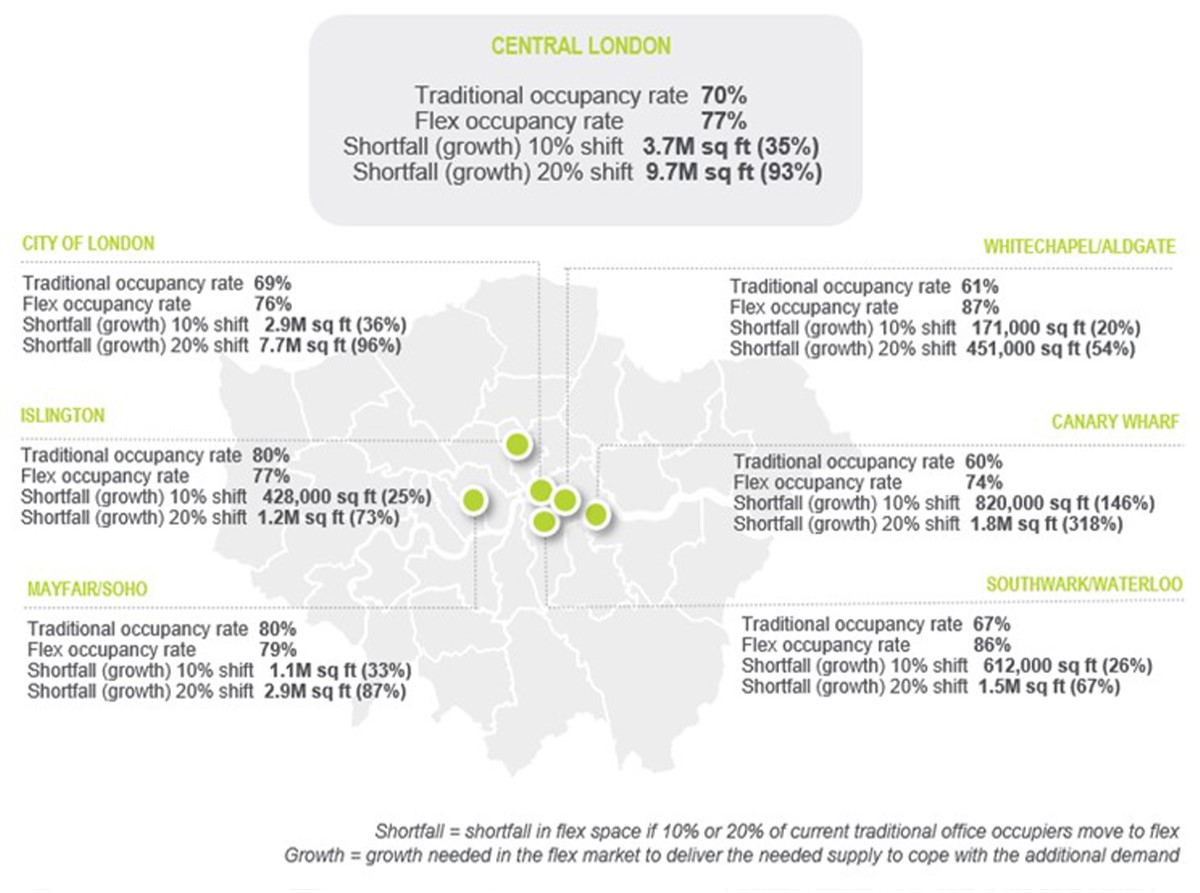

London is the most mature flexible workspace market in Europe, and as workers start to return to the office in the capital, occupancy rates within flex workspaces remain well above those of traditional offices.

If 5% of leased office tenants move to flex, many areas of London are well-positioned to meet such demand and would need supply to grow by just 6% or less to deliver the space needed. However, Canary Wharf is dominated by traditional office buildings and in this market, flex office share is significantly less, with a shortfall of over 50%.

If closer to 10% of office tenants transition to flex, this puts additional pressure flex supply across London, but supply would not need to ramp up as much as it would in the UK’s regional cities. However, with a 20% shift, the central London flex market would see a shortfall of 9.7 million square feet, equivalent to over 90% growth.

What we are also seeing is a change in size of occupier requirements, with a larger number of corporate occupiers moving to flex. This will result in occupancy rates across the capital changing very quickly, driving further need for additional supply of flex.

CAN SUPPLY KEEP UP?

The pandemic has catalysed a shift in landlords’ attitudes to the flexible office sector. Previously they had only experimented with flexible space but are now questioning how much flex they need to incorporate into their portfolios to stay competitive.

For example, GPE has announced that it aims to grow its flex offering from 13% to 25% of their total portfolio by 2027, and CBRE has taken over the management of 40% of Industrious’ coworking spaces to boost their flex product.

Is under-occupied space the answer?

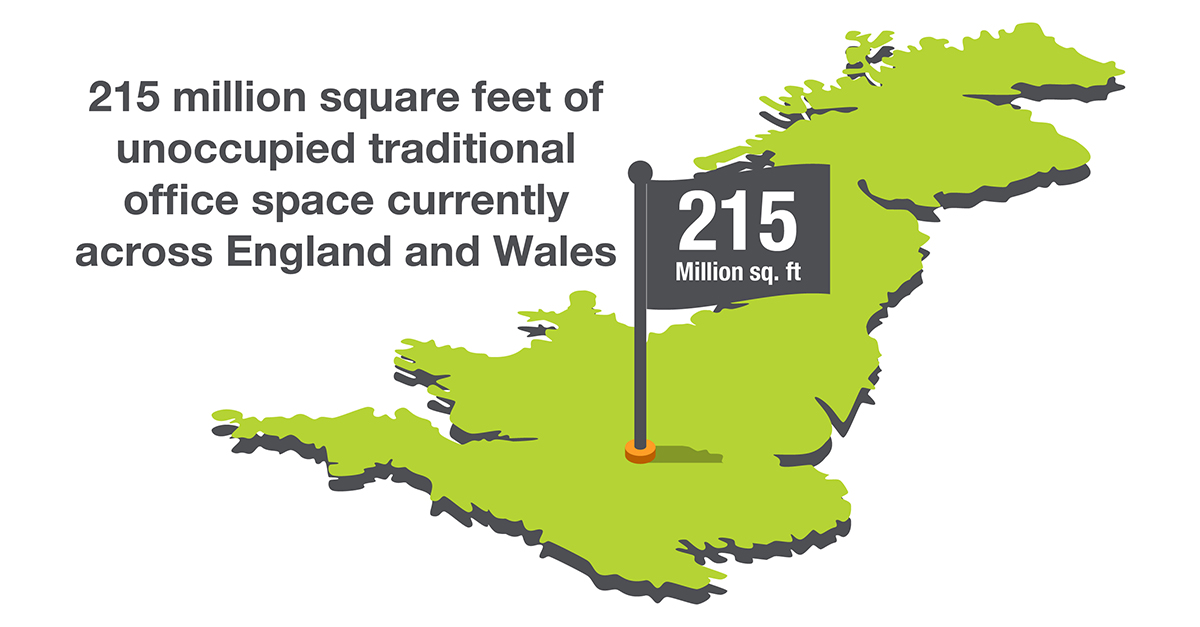

With over 215 million square feet of unoccupied space across England and Wales, landlords could well hold the key to unlocking the supply needed to enable the flex market to grow at speed. Just 19% of available traditional space needs to convert to flex to meet demand if 10% of occupiers transition to flex.

As more landlords strive to make their buildings accessible to businesses of all types and sizes, this goal is well within reach. However, this shift is not without its challenges, as running space that is more operationally intensive with different services and amenities incurs additional time and costs. Fortunately, management agreements and partnerships with existing operators offer an alternative route to landlords not wishing to establish their own flex arm.

There are also vast amounts of empty retail space on high streets across the country which could be repurposed into flexible workspaces, as well as vacant storage and industrial units. One thing is clear: the space needed to expand flex supply exists in many forms, creating a vast opportunity for the flex sector to grow.

WHAT DOES THIS MEAN FOR THE FUTURE?

The perception of work has shifted, and the office market must move to meet changes in demand. The result of this will be a blurred line between flex and traditional office spaces. As supply of flex space grows and diversifies, occupiers will be provided with a wider range of solutions to meet their needs.

After addressing their initial concerns around a forthcoming recession, the medium-term goal for many businesses will be to enhance staff productivity and retain corporate identity – landlords and operators will need to work together to provide the types of space, in the right locations, that match these critical objectives.

Methodology

All data is delivered via Instant Insights in partnership with EG unless stated otherwise.

Flexible workspace data - data within the report is compiled via The Instant Group’s leading flexible workspace data platform Instant Insights. The size of the flexible workspace market is calculated using data provided to The Instant Group by operators and occupancy rates are based on a sample size of 456 flexible workspaces across the UK.

Traditional office data – provided by EG