The return to the office across Australia is continuing to show momentum despite a third wave of Omicron. With offices reopening twice since the beginning of the pandemic in early 2020, a third opening in the first quarter of 2022 has seen more return than the previous year, showing promising signs across the country.

KEY FINDINGS

- Sydney CBD has seen the highest rates in occupancy since the start of the pandemic, boasting 80% office occupancy.

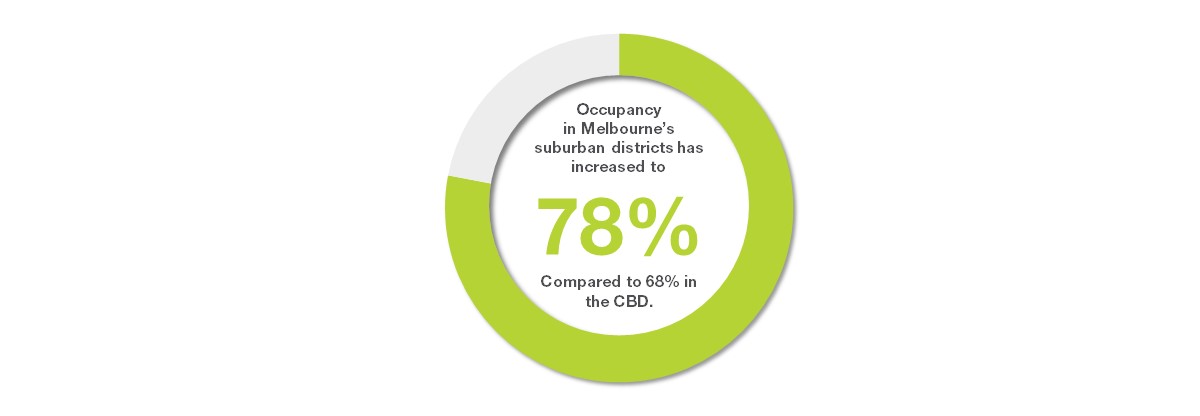

- Melbourne is still yet to recover from the pandemic, but we have seen occupancy rates in suburban districts increase to 78% compared to 68% in CBD as employees place greater importance on lifestyle choices.

- The longstanding impacts of Covid-19 has allowed many businesses to utilise hybrid working into their workplace strategies.

- Overall rates across Australia are up by 1% in Q2 2022 when compared to Q2 2021. Many operators are now betting on a stronger performance in occupancy rates later this year.

1. OCCUPANCY RATES ON THE RISE BUT RECOVERY IS UNEVEN

While individual occupiers have put in place their own protocols for a safe return to the office, businesses are now reacting to hybrid working, with many firms now making the move from traditional to flex. Since many employees have indicated they have no desire to return to the office 5-days per week, an array of businesses continue to react by allowing staff a mixture of working from home and going into the office. The seismic shift in attitudes from employees has ultimately put pressure on businesses to adapt agile working into their workplace strategies, with companies such as Atlassian, Appello, and one of Australia’s biggest banks, ANZ, all allowing employees the chance to work from home a few days per week, and in some cases, permanently.

With some businesses slower to return to the office than others, those that have made a move back have re-evaluated their workplace strategies and have used hybrid working as an opportunity to cut down on costs and help attract and retain talent from further afield. According to a new employer survey, more than one-third of Australian businesses are encouraging their staff to return to the office a few days a week by the end of 2022, with many workers now responding.

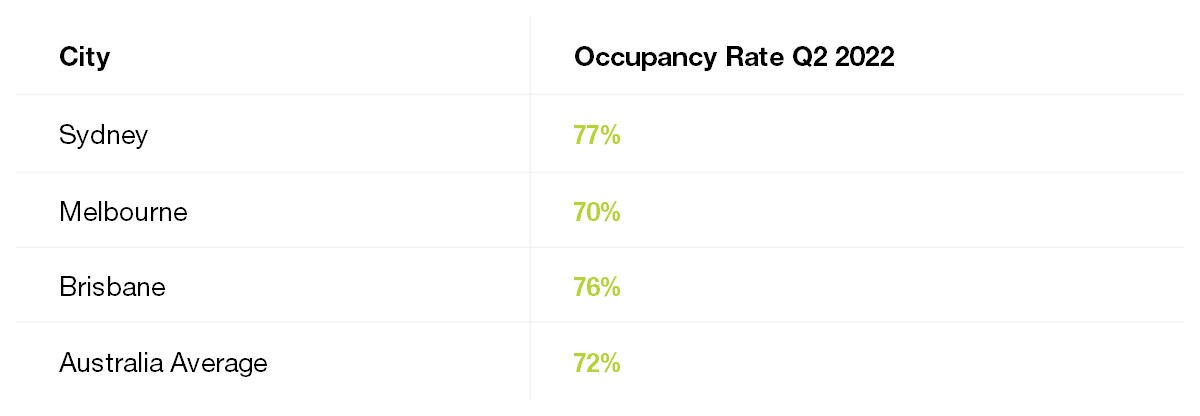

As a result, this is leading to an increase in occupancy rates in some part of the country, especially in Melbourne and Sydney as a whole, which have seen rates increase by 4 percentage points and 3% respectively, in Q2 2022 when compared to Q2 2021. Despite occupancy still below pre-pandemic levels, we have seen demand for flexible office space increase in some parts of the country, especially in Brisbane, Canberra, and the Gold Coast. In Brisbane, we have seen occupancy rates reach 76% in Q2 2022, which is above the national average of 72%. Conversely, Melbourne is still below the national average due to people being a bit slower to return to the office due to strict lockdowns and more companies embracing hybrid working.

2. SUBURBIA: A TRANSITION OF WORK-FROM-HOME TO WORK-NEAR-HOME

Due to the nature of the market, we have seen some firms relocate outside of city centres and into the suburbs, a trend we are seeing across key markets across the globe. There is an array of advantages to companies and employees making the move to the suburbs, such as cheaper rates, lesser commute times, and a vibrant and community-minded design due to bigger office spaces. This has been the case in Melbourne suburbs, where popular suburban areas such as Box Hill, Hawthorn, Heidelberg, and Richmond have all seen interest in flexible workspace at least double over the past year compared to pre-pandemic levels. This has pushed occupancy rates in Melbourne’s suburban districts up to 78% in Q2 2022, compared to 68% in the city centre.

However, this trend is not playing out in all the cities across Australia. In Sydney, we have seen the opposite, where occupancy rates in the CBD achieved 80%, the highest since the start of the pandemic, with rates in the suburbs reaching 72%. Sydney CBD has seen major interest from large corporates for new and bigger office buildings, sparking new optimism for the future. In fact, a new A-grade tower is being developed by the private Third.i Group for a $327m office building that offers huge open spaces with advanced technological features due for completion in 2023. Other factors including the fact that Sydney is a highly sought-after city and is a more mature market can explain why occupancy has seen an increase over the past year. As a result, workers across Sydney, the most populous city in Australia, are commuting back to the office which is helping CBD occupancy rates.

3. WHAT DOES THE FUTURE HOLD?

The repercussions of Covid-19, combined with inflationary pressures, have hit many businesses hard. As a result of the uncertainty within the economy, businesses will continue to prioritise greater flexibility instead of taking out long term traditional leases for office space. This in turn is now a time of opportunity for the Australian flex industry, due to its flexibility which can provide businesses with the security and peace of mind during uncertain times. The supply of flexible offices across APAC is set to grow by 73% between 2022-25, with many operators looking to expand their footprint across the market. Given the increasing demand for flexible office space and the robust financial returns it can provide, we are now seeing landlords enter the market by providing their own flexible office space solutions, such as Goldfields Group who have recently launched The Loft at South Yarra. Our experience indicates that operators should be aiming for stable occupancy rates of between 80- 90% in order to maintain profitability. In the short-term operators will be focusing on increasing their occupancy to reach a profitable level and therefore we may see workstation prices remain low. As occupancy rates continues to increase, we may see prices start to increase particularly with added inflationary pressures within the economy.

Flexibility is undeniably becoming a critical element for businesses – short term, the flex industry allows for new workplace solutions to be tested in both a low-risk and crucially low-cost manner, while longer-term the industry enables future agility allowing companies to develop cost-effective strategies that also deliver at an employee level.

Want to learn more about the Australia Flex Market? Download our 2022 Australia Flex Market review today.