Throughout the course of the pandemic, those both inside and outside the industry have often predicted that the agility inherent in the flexible workspace industry would result in buildings emptying and many operators going out of business. In our previous review of how occupancy rates in the UK had been impacted by the pandemic in November last year, we reported that occupancy rates had indeed fallen, but not by anywhere near the levels that had been predicted. Now, 6 months on, we take a look at how this trend is changing as restrictions are lifted and employees start to return to the office.

KEY FINDINGS

1. OCCUPANCY VS DENSITY

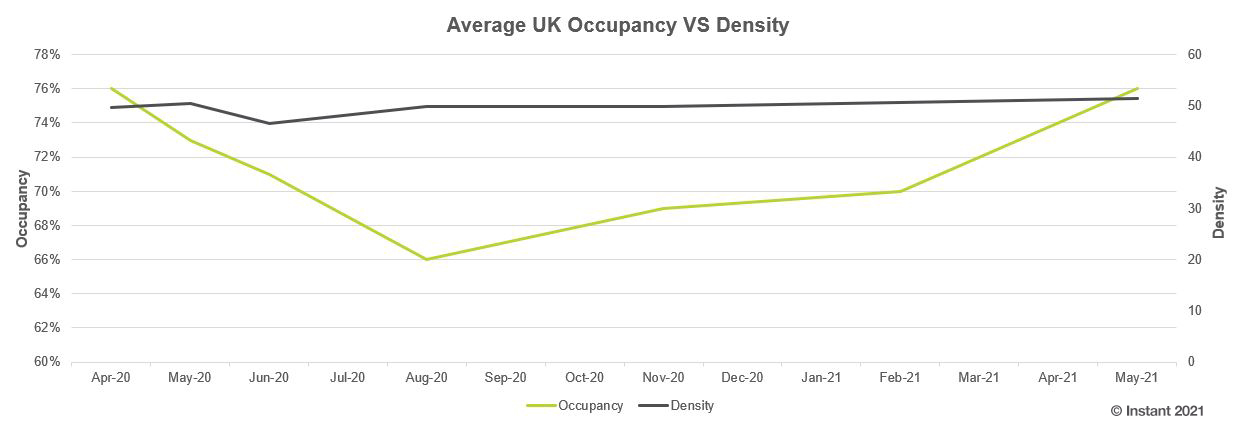

Occupancy levels across the UK have started to rise more sharply since February this year, and are currently at an average of 76%, the same as those seen at the very start of the pandemic. However, whereas occupancy rates have fluctuated in line with the tightening and easing of restrictions, density rates on the other hand have remained relatively stable at an average of 49.8 sq ft per workstation across the UK. Instead of allowing additional sq ft per desk, operators are instead temporarily closing off spaces to allow clients to protect the wellbeing of their staff.

City-level comparison

At a city level, occupancy rates across key cities are converging towards a more consistent trend, whereas rates varied significantly between cities during the early stages of the pandemic. Cities such as Reading and Bristol currently enjoy some of the highest occupancy rates in the country at 86% and 83% respectively. When restrictions were at their tightest, occupancy rates in some cities such as Edinburgh fell close to 50%, whereas during Q2 2021 occupancy rates across all key cities analysed were over 70%, a very positive sign for the recovery of the industry.

Occupier mindset

Despite the change in working patterns over the past year, demand for office space has not disappeared. Instead, the occupier mindset has changed and both employers and employees alike see flexible workspace as supporting and enhancing the flexible working model rather than being a redundant asset. Flex space will be the key to achieving this balance and, as a result, we fully expect occupancy rates to continue on this upward trajectory over the coming months.

2. WHO IS DRIVING THIS DEMAND?

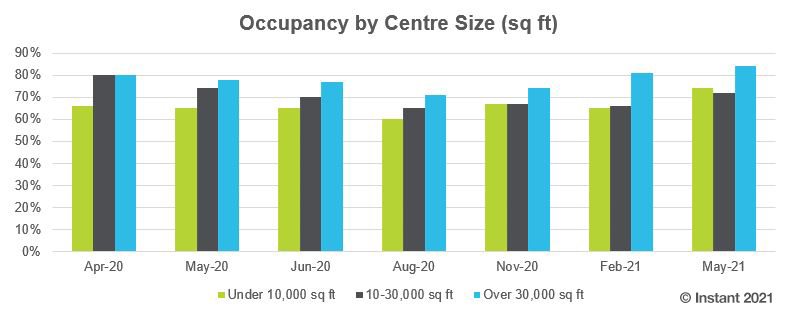

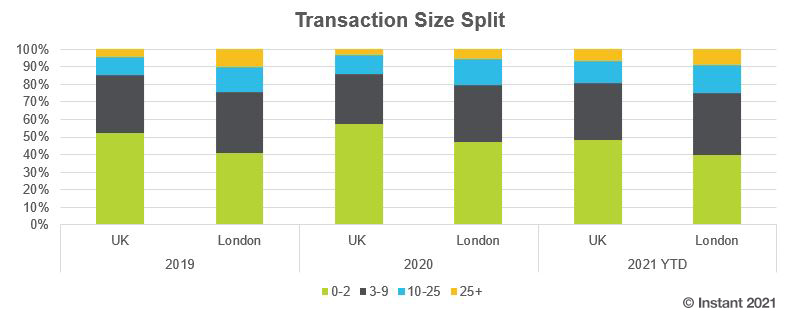

The trend previously identified showing higher occupancy rates among larger flexible workspace centres of over 30,000 sq ft has continued, with these centres currently boasting an average occupancy rate of 84%, 10 percentage points above that for centres under 10,000 sq ft. This mirrors the growing shift towards companies taking larger spaces within flexible offices, with the proportion of transactions for under 2 workstations decreasing while that for 10 workstations and above is on the rise.

Importance of flexibility

Our research shows that larger companies are now identifying with the benefits of flexible space, be that for head office renovations, additional team space or overflow space. Whatever the motivation, flexibility is now a key business asset for corporate companies and they are being more proactive in their decision making processes. The ability to adapt real estate to meet the changing needs of the workforce who occupy them is now a top priority for heads of business, but more than that they need to be in a position to react quickly to any future changes.

Time of opportunity

Lower occupancy rates within some markets presented a unique opportunity for corporate companies looking for larger floor plates within flex space. Larger spaces were previously a rarity within sought after locations and so those able to move quickly could acquire high-quality space on favourable terms. Larger centres able to offer large available spaces were the ones in a position to transact with these requirements, resulting in higher occupancy rates among these centres.

Now is the time to act

Not only were companies looking for larger spaces able to capitalise on the rare provision of larger spaces and floor plates brought about by lower occupancy rates during the early stages of the pandemic, but lower flex workstation rates in CBD areas also enabled them to acquire good quality space in a central location at a lower cost. Based on what we are seeing in other markets that are quickly recovering from the impacts of the pandemic, rates could well quickly rise in line with growing demand, and this coupled with increasing occupancy rates across many markets means that now is the time to act and move to flex.

3. THE CAPITAL IS FAR FROM DEAD

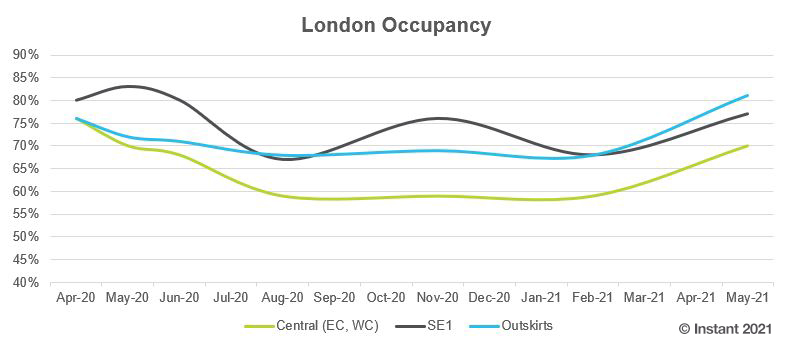

Up until early 2021, occupancy rates within central London were declining, causing much speculation surrounding the future of capital cities. However, with rates now on the rise again, there are renewed signs of life within central London.

Although the highest occupancy rates are within the outskirts of the city, with some employees still being reluctant to travel into city centres on public transport, occupancy rates within the EC, WC and SE1 areas have increased significantly since early 2021 after being stagnant for some time, something which commentators did not anticipate at the end of last year.

Office redesign and repurpose

The upward tick in occupancy suggests a changing shift in sentiment towards the office. Occupiers have taken the time to review their office portfolios and rather than replace the office with home working, they are instead focussing on redesigns, repurpose and greater emphasis on employee experience to entice employees back into the office.

Many companies still need a central HQ in order to enhance their company brand and culture. However, this central office will be supported and enhanced by a mix of smaller spoke locations and home working. Flexible workspaces enable companies to test, measure and adapt their portfolios in order to achieve the right balance for their business.

Younger cities

Instead of being on the brink of death, many commentators believe that city centres are getting younger. Younger generations thrive on the human interaction in larger cities, as well as needing face-to-face contact with their co-workers to learn and share ideas. Capital cities offer unique cultural, social and work experiences and so will continue to attract younger (and some older) generations who are not willing to give up office life.

It is impossible to recreate the experiences offered by office-working at home and so occupancy levels within city centres are expected to recover, albeit in an office which may look and feel very different to what it did pre-pandemic

4. MOVE TO SUBURBS – REGIONAL VARIATIONS

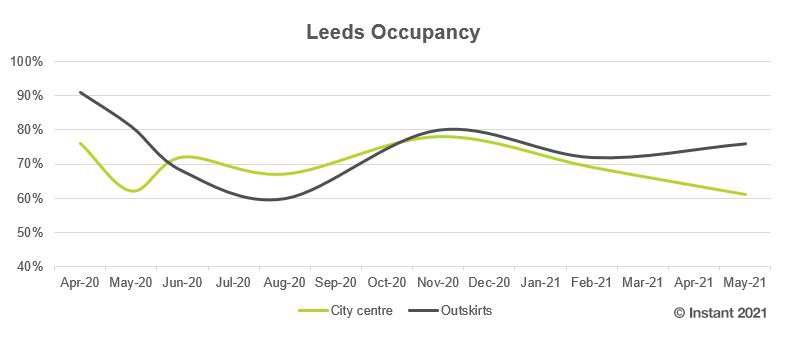

Although occupancy rates are on the rise in some city centres such as London and Manchester, in other secondary markets city centre locations are much slower to recover. In Leeds for example, occupancy rates in both the city centre and outskirts were falling up until the end of 2020, however as restrictions started to be lifted earlier this year, occupancy in the outskirts rose up to 76%, 15 percentage points higher than that in the city centre.

What is driving demand to the suburbs?

The importance of location has been thrown into question by the pandemic and many occupiers are considering if a single, centrally located office could be downsized and supported by a number of spoke locations and home working. The implementation of this hub and spoke model would bring many benefits for both the employer and employee, including reduced real estate costs, improved talent retention and attraction, reduced commute times and costs and improved work/life balance. The extent to which this new model will take hold is yet to be seen as there are many factors which need to be considered to determine if it could be successful for individual companies.

No one-size-fits-all solution

Trends like those we are seeing in Leeds are also evident in other global markets, such as Melbourne, where occupancy rates are recovering much more quickly in the suburbs than in the city centre. However, although the benefits of flexible workspace locations in the outskirts of cities are clear to see, it is not a one-size-fits-all solution and the success of a hub and spoke model will depend on transport infrastructure, demand/supply imbalances, provision of high-quality spaces and the share of working population living outside the CBD, among others.

While we do expect the hub and spoke model to drive demand across many markets, centrally located hub offices will not disappear entirely and so occupancy rates in CBDs will recover, albeit at a few paces behind the more popular suburban areas.

5. A TIME OF OPPORTUNITY FOR CLIENTS

Summary & Conclusion

The flexible workspace industry is emerging from the wake of the pandemic in a much stronger position than many would have predicted. Not only did occupancy rates not fall anywhere near the levels that were expected, but they are rebounding quicker and stronger than anticipated.

The inherent flexibility in the industry which led to the initial drop in occupancy rates, is now a key driver for many businesses when establishing their office portfolio for the future. Heads of business are now identifying with the benefits of incorporating flexible workspaces into their real estate, resulting in an increase in larger companies moving to flex and capitalising on the unique opportunity that lower occupancy rates have offered them.

We have seen nuances across different markets, with both suburban areas and city centres showing varying speeds of recovery. However, recovery is the key and occupancy levels are undeniably on the rise and we expect them to remain on this upward trajectory in the coming months and for the industry to adapt and thrive as a result.