Our latest data indicates that flexible workspaces have firmly established themselves as a preferred asset choice, evidenced by an impressive 17% increase in global transaction sizes during the first quarter of 2024.

As space utilisation and expectations evolve, competition for tenants is intensifying between the flexible workspace sector and the traditional real estate industry.

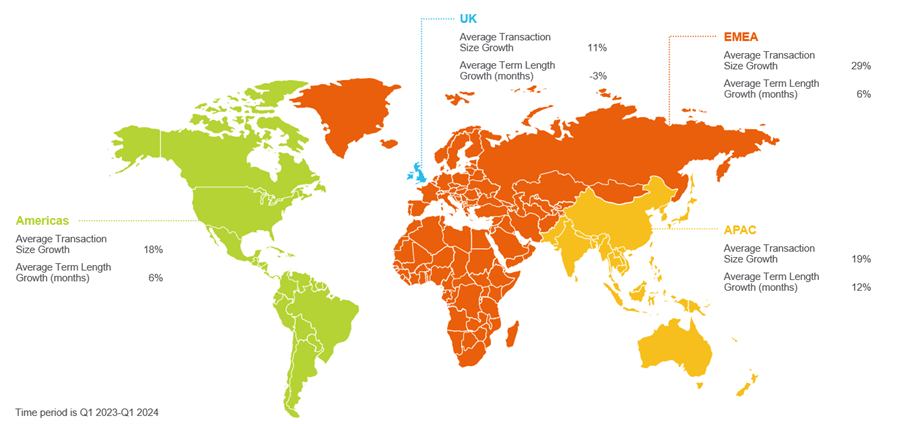

In the flexible workspace sector, transaction sizes are on the rise, increasing by 17% globally from Q1 2023 to Q1 2024, accompanied by a 4% increase in contract lengths over the same period.*

These stats exclude a single large flex transaction in the Americas region, which, if taken into account, would push the increase in transaction growth size up to 149% in the Americas and 49% globally.

Currently, 63% of landlords worldwide anticipate a decline in demand for traditional leases over the next 2 years and are responding by incorporating greater flexibility and concessions within their leases.

Workspace providers must prioritise enhancing their offerings to leverage larger requirements and propel the future growth of the industry.

OCCUPIER DEMANDS: A SHIFTING LANDSCAPE

The growing need for agility and scalability is driving larger corporate occupiers to increasingly adopt flexible workspace solutions. The Americas (+18%), APAC (+19%) and EMEA (+29%) regions have all experienced significant growth in flex transaction size, while the UK has seen more modest growth (+11%).

The maturity of the UK flex market means that the shift in occupier size has not been as stark, as many corporate companies started capitalising on the benefits of flex well before the evolution of hybrid working patterns.

This trend has gained momentum since the beginning of the pandemic, with global transaction sizes currently up 29% on pre-pandemic levels (Q1 2019), while APAC demonstrates a remarkable surge of 156% compared to Q1 2019.

Growth is driven by the increasing adoption of flexible workspace solutions among larger corporate occupiers. The global share of transacted desks for requirements of 26 or more desks has risen from 30% in Q1 2023 to 50% in Q1 2024, while the share of transacted desks for 1-2 workstations has decreased from 10% to 7%.

Evolving occupier preferences, coupled with increasing confidence in the long-term viability of flexible workspace solutions, is leading to a rise in flexible lease lengths. Globally, lease lengths have increased by 4% over the past year (Q1 2023-Q1 2024), with the most significant increases observed in APAC (+12%).

OCCUPIER DEMANDS SHAPING LANDLORD DECISIONS

Landlords are acknowledging the need for greater agility within their leases. Globally, 83% of landlords are witnessing an increase in demand for flexible space compared to long-term traditional leases.

In response, many are adapting by offering greater flexibility and concessions within their leases, including shorter lease terms and extended rent-free periods.

This fundamental shift will drive a new wave of supply from landlords, with 63% of them planning to expand their offerings with flexible space to meet new demand.

The greatest increases are expected in the UK (77%) and the Americas (63%), reflecting a strategic response to evolving occupier preferences and market dynamics.

Asset owners that can effectively integrate flexible products and services throughout their portfolios can unlock potential rental premiums and additional revenue streams by offering greater choice in terms of scale and diversity.

The evolution of occupier needs is poised to bridge the gap between the flexible and traditional real estate sectors, fuelling a significant market transformation. To learn more about diversifying your office assets with flex products and services, contact our team today.

___________________________

Methodology

Data within the report is compiled from The Instant Group’s proprietary data and The Instant Group’s 2023 Future of Flex Survey, conducted in Q3 2023 across 200+ UK operators and landlords.

*Note: this data excludes a single large transaction in the Americas regions which would push the average transaction size growth for Q1 2024 up to 149%